REASONS TO INVEST

Tax Benefits

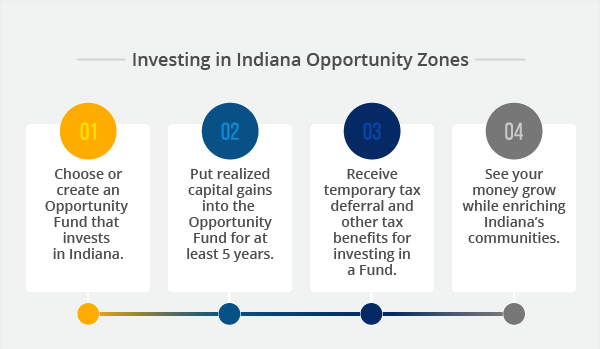

Investments made by Opportunity Funds into certified Opportunity Zones can receive three key federal tax incentives to encourage investment in low-income communities, including:

1. Temporary tax deferral

for capital gains reinvested in an Opportunity Fund

2. Step-up in basis for capital gains reinvested in an Opportunity Fund

3. Permanent exclusion from taxable income of long-term capital gains

For additional information on the

treatment of capital gains invested and earned through the Opportunity Zones program, please see this summary published by the Economic Innovation Group based in Washington, D.C.

Community Benefits

Indiana is well positioned for investment through the Opportunity Zone program because

of the state’s competitive tax climate, efficient regulatory system, low permit backlog, AAA credit rating and balanced state budget.

Investors are interested in Indiana’s Opportunity Zones because of the state’s

diversified economy along with its pro-growth business environment, low cost of living and low unemployment. These factors help solidify Indiana as a safe and exciting place for investment where possibilities become realities without the headache

of government overreach.

When determining the locations for the Opportunity Zones, Former Governor Holcomb solicited recommendations from around the state. Local officials, stakeholders, and citizens responded and highlighted why their communities

would benefit from the designation. This extra step shows that Indiana's opportunity zones are engaged and ready to partner with investors so they can realize their visions.

This page will be updated as the U.S. Department of the Treasury continues to release guidance on the Opportunity Zone program. Please contact OpportunityZones@gov.in.gov if you have any questions about the Opportunity Zone program.